Fix QuickBooks Payroll Error 30159 With Easy Steps

Sometime when the QuickBooks user tries to upgrade the payroll or while working on the company’s payroll, it’d grind to a halt within the center of the work thanks to the QuickBooks Payroll Error 30159. But how does it actually appear? and therefore the way it affects the working of the QuickBooks? Well, here is that the entire solution to urge obviate error 30159. you’ll contact experts via QuickBooks Support Number to use of those steps.

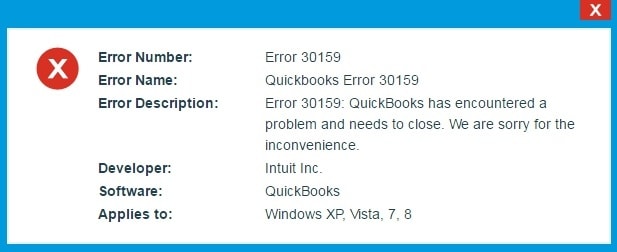

What is QuickBooks Payroll Error 30159?

QuickBooks Error 30159 is particularly a payroll error that happens because of improper file setup within the OS of your PC. The error arise due to improper file setup within the OS of your PC.

Whenever you start your system the error message display on the screen that means the error has already appeared in your QB payroll. because the error is daunting and may stop your payroll work, and you won’t be able to use your QB payroll until it completely vanishes. Therefore, you’d wish to perform such steps to rectify the error. But before this, you need to remember of the possible reasons thanks to which the error can occur.

Causes of QuickBooks Error 30159

Let’s look the given steps :

- When your QB company file is broken or corrupted

- EIN Status is inactive

- QuickBooks Installation Error happens

- If you’ve not updated your Windows version

- Or if you’ve not updated your QuickBooks

- When your Windows Registration File corrupts

- Corrupted or damaged due to virus or malware.

- Improperly deleted the hardware file

- Wrong information by the damaged file system

How to resolve QuickBooks Payroll Error 30159?

There are number of solutions that you simply can easily apply and solve the error. See below-mentioned solution:

Solutions 1: Manually Update the System

- Log in your system as Administrator

- Select All Program

- Click on Accessories and click on system tools on your screen

- Select system restore

- Click Next

- Continue doing until the confirmation window appears

- Now restart your computer after processing

Solution 2: QuickBooks Error Scanning

- Install the QuickBooks Payroll Error Code utility 3015

- Now install the program, and proceed

- Select the scan option

- And, start scanning

- After scanning select Fix QB Errors.

- Next, you’d wish to restart your PC

- After restarting check if the error has vanished or not. If not, then move to subsequent solution.

Find more-: Balance Sheet Issues Sage 50

Solution 3: Performing Disk Cleanup

Here during this step, you’ve to perform Disk Cleaning on your system, this method is typically effective to resolve most of the errors in QuickBooks.

Solution 4: Use System Restore in Windows

- How to fix search system using reset step

- Select System Restore

- Now, enter the administrator passwords

- Next, follow the steps within the wizard

- Restore your system

- Hence, after performing these steps you’ll resolve the error this daunting error from QuickBooks very soon.

Solution 5: In QB Company File add your EIN

- First, you’d wish to log in QuickBooks

- Click Select Payrolls option

- Now click on ‘Use my existing payrolls service’

- Open the e Account Maintenance on the screen

- Select Add File

- Mark the radio button opposite to feature EIN Number

- If you notice that radio button is disabled, then you’ve already correctly subscribed to EIN Number

- Now click Next

- Remember to review all the knowledge

- And, now return to QuickBooks

- Also Find-: QuickBooks Error 6123,0

The 5th solution is additionally completed and thus the above solutions are directed by the QB experts. you’ll simply perform these steps in your home and rectify the error without anyone’s help.