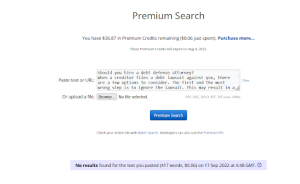

When a creditor files a debt lawsuit against you, there are a few options to consider. The first and the most wrong step is to ignore the lawsuit. This may result in a default judgment, and you won’t have the chance to challenge the creditor. You can choose to defend yourself in the lawsuit, which again can backfire if you don’t understand the process. Your best bet is to hire a debt defense attorney who will represent you in court and for negotiations. Top firms like Zero Debt Law Firm in Chicago offer all the help that clients need for such cases. In this post, we are sharing more on how an attorney can help with debt defense.

Common strategies that an attorney can use

Many lawyers would first check all the evidence to decide whether your lawsuit will hold. There are several ways to defend a debt lawsuit. They can prove that the statute of limitations has expired, which means the creditor has filed the case too late, or the creditor filed the lawsuit for a wrong amount or in the wrong court. It is also possible that you are a victim of mistaken identity or identity theft, which essentially refers to a situation when you don’t owe the debt in the first place. It is also possible to argue that you have partly paid for the debt or that the debt was already discharged during bankruptcy.

Debt defense strategies that won’t work

If you claim that you couldn’t repay the debt owing to certain situations, it wouldn’t be considered a defense for your case. You cannot also say that you have no money to repay the debt or that the creditor failed to negotiate the payment with you. Whether or not the creditor agrees to make reasonable arrangements for repaying the debt is at their discretion.

Your lawyer can help file a counterclaim

In some cases, you may have a counterclaim against the creditor. For instance, if the creditor has altered the debt documents or has tried means and ways to get the money illegally, you could have a case. A debt defense attorney can help prove these details.

Seek legal help immediately

Don’t let the creditor get a default judgment, and your basic step should be to ask for legal help from an experienced attorney. Most debt defense attorneys don’t charge a high fee for the first meeting and will evaluate your case for a nominal amount.